reit tax benefits uk

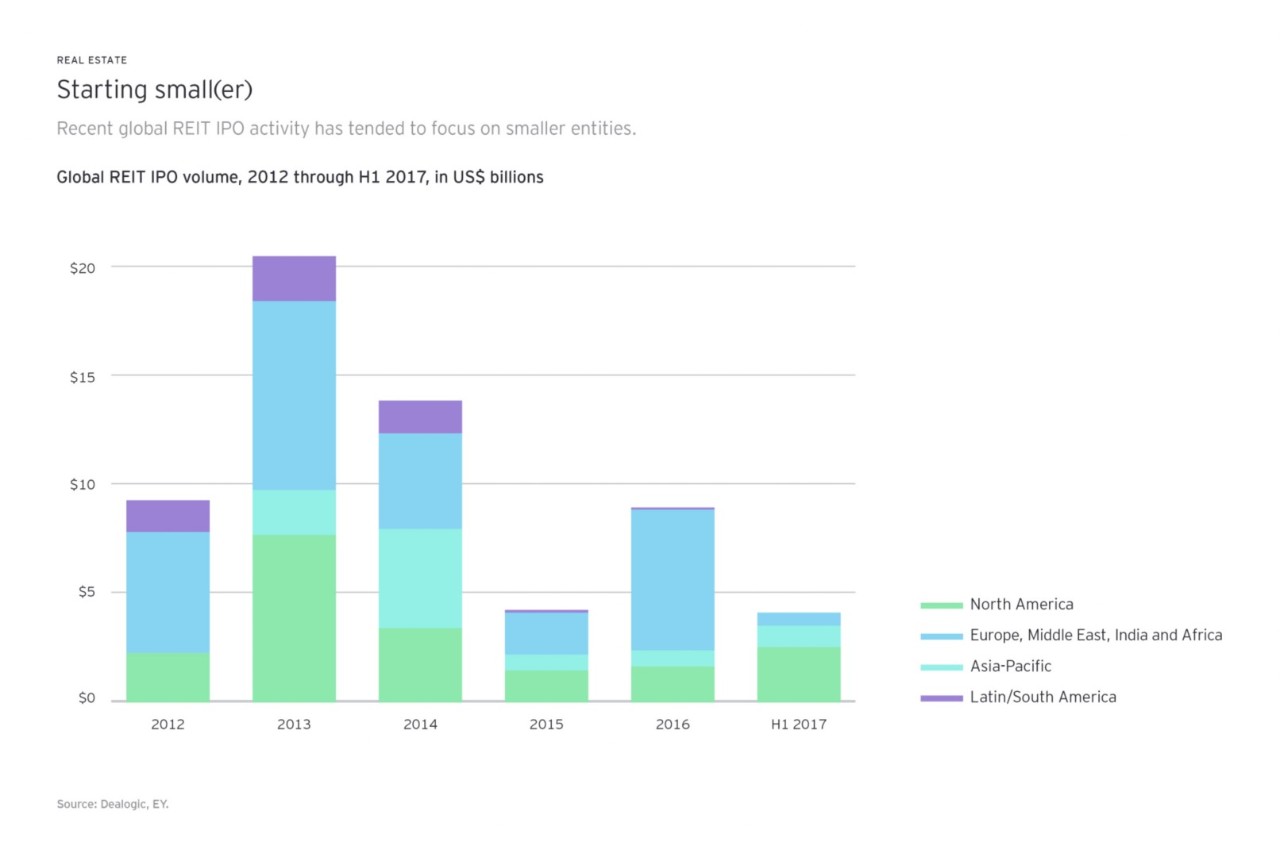

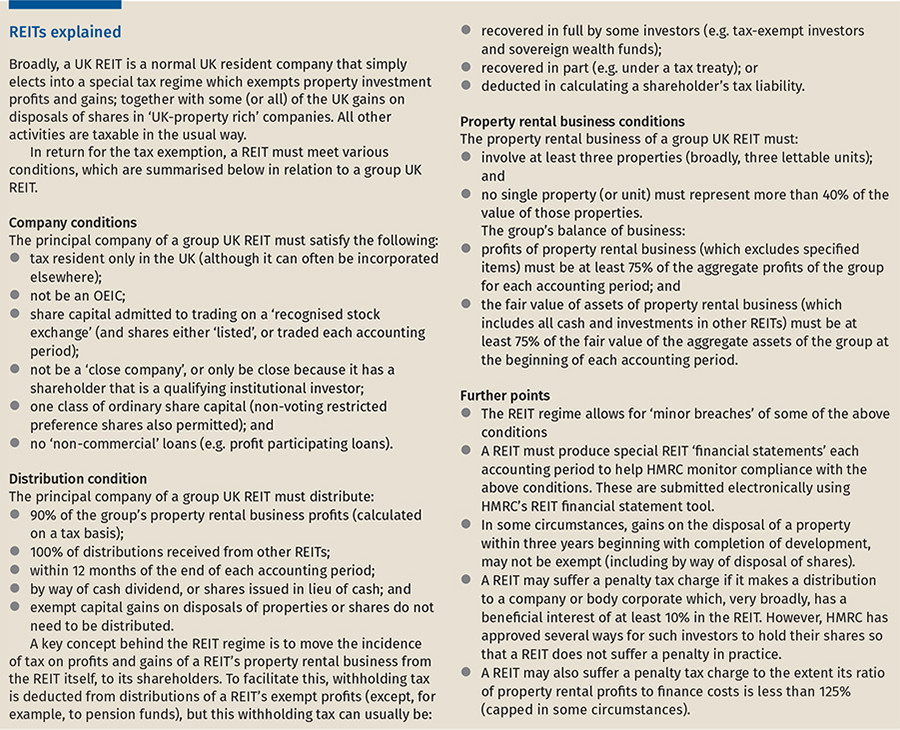

As at October 2018 there are c75 UK REITs. A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received.

5 rows Advantage 3 - Tax Efficiencies.

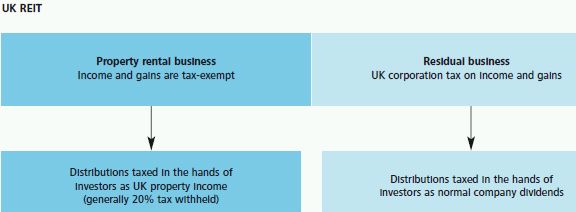

. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. A real estate investment trust REIT is exempt from corporation tax on qualifying rental income and gains on sales of investment properties and shares in property investment. For example the France UK tax treaty allows REITs to benefit.

Corporation Tax is payable on its profits and gains from. In this way the taxation. The benefits for companies and the benefits for individual investors.

Where the UK-REIT satisfies the relevant conditions its rental income is exempt from corporation tax as are capital gains on the disposal of rental properties. First the tax treaty can expressly mention the REITs as beneficiaries of the provisions of the tax treaty. The anticipated advantages of a UK REIT include the following.

Your REIT Income Only Gets Taxed Once When a typical corporation makes money it has to pay taxes on its profits. Property investment becoming more accessible and desirable for all types of investors from pension funds who would be. Benefits for companies Tax.

Not only does REIT income avoid taxes on the corporate level but if you hold your publicly traded REIT investments in the right account type REIT distributions can avoid tax. The point of a REIT is that it can enjoy exemption from corporation tax on its property rental business and also on any gains from disposals of properties that form part of. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

The Average Annual Return For All Fundrise Client Accounts Was 2299 In 2021. A high distribution requirement also protects the UK tax base because the point of taxation for a UK REIT is in the hands of investors where distributions may be subject to. If it pays a dividend to.

Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. REIT Tax Benefits No. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. REITs benefit from some pretty special tax advantages. Each year a UK REIT has to distribute at least 90 of its taxable income to shareholders where this income is treated as property rental income rather than dividends.

The income from a REIT investing in another UK REIT is treated as income of the investing REITs tax exempt property rental business provided the investing REIT distributes to. This includes publically traded REITs generally listed or traded on the London Stock Exchange as well as institutionally owned REITs. Taxation of a UK REIT A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status.

This allows it to benefit from exemptions from UK. The benefits of REITs can be broken down into two separate categories. Get your free copy of The Definitive Guide to Retirement Income.

A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business.

Weekly Roundup 28th October 2015 7 Circles Stamp Duty Personal Finance Finance

Reit Dividends And Uk Tax Assura

Real Estate Investment Trust Know The Nitty Gritty Of Reits Before Investing The Financial Express

Reits Uk Explained How To Invest In Property Using Reits Real Estate Investment Trusts Youtube

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

You Can Learn New Ways To Increase The Profitability Your Property Investments By Checking Out Our Real Estate Investment Trust Real Estate Investing Investing

Reits The Next Vehicle For Midstream Assets Lexology

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Difference Between Epf And Ppf Income Investing Investing Basic

Uk Reits A Summary Of The Regime Finance And Banking Uk

Taxation Of Reits Ringing In The Changes

How Income Tax Rules Help Reit Investors Earn More In Long Term

Reits Real Estate Investment Trusts And Tax Tax Worldwide

Reits Vs Real Estate Mutual Funds What S The Difference

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

How To Invest In Reits Real Estate Investment Trusts Real Estate Investment Trust Investing Real Estate Investing